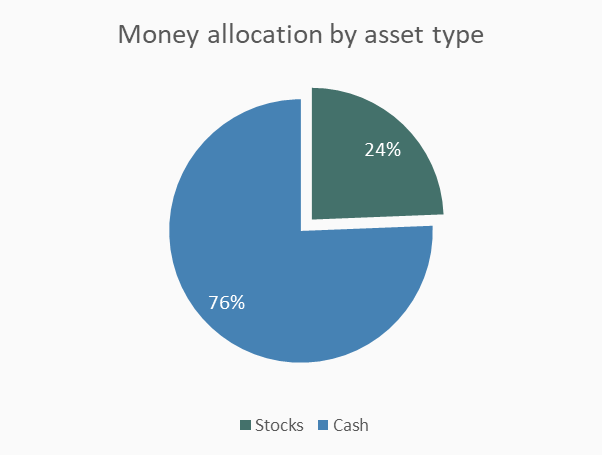

Only 24% of my funds are at play today

Usually, 80-90% of my funds are invested in US stocks. This changed from late February until the middle of March, when I sold most of my stocks due to a change in my perception of the market’s direction.

When it comes to investing, my strategy is straightforward and focused. Here’s how I allocate my funds:

Stocks: 80-90% of Savings

I invest the majority of my savings in stocks, typically 80-90%. The reason for this is simple: I am already long cash due to my full-time job, which provides a steady income at the end of every month. Additionally, I can easily switch between jobs thanks to the strong labor market for my profession and location. The state where I live also offers full salary coverage for at least 8 months in case of unemployment, making it unlikely that I would suffer from not having a large cash reserve.

US Stock Market

When I invest, I focus on the US stock market. Historically, it has provided the best returns, with the NASDAQ averaging 11% and the S&P 500 averaging 8-10% per annum. This makes it a reliable choice for long-term growth.

Why EU Stock Market now

I believe the EU markets finally have some room to grow due to several key factors. Firstly, the new Chancellor of Germany, Friedrich Merz, has shown a commitment to market liberalization and economic growth. His policies aim to reduce regulatory burdens and support businesses, which could stimulate economic activity across the region. Additionally, the ReArm Europe Plan, spearheaded by the European Commission, is set to significantly boost defense spending and enhance the continent’s security infrastructure which always leads to broader economic growth. Furthermore, substantial investments in the EU economy are being made to foster independence and resilience. For instance, Germany’s recent approval of a €500 billion infrastructure investment fund is expected to revitalize the euro area’s largest economy. These combined efforts create a favorable environment for the EU markets to thrive.

Moreover, the current valuations of EU companies offer great discounts. If we can identify companies capable of growing their earnings, these could become excellent investments for part of our portfolio. This strategy allows us to capitalize on the potential growth in the EU market while waiting for the dust to settle in the US or for it to become easier to invest in Indian companies.

Debt: Bonds and P2P Lending

The only other asset class I consider is debt, including bonds and peer-to-peer (P2P) lending. These investments offer predictable cash flows and are associated with relatively low risk (bonds). However, it’s important to note that they are not risk-free. The price of a bond can fluctuate significantly, and selling at the wrong time can disrupt your cash flow expectations. The credit risk for P2P is quite high not only from the side of the borrower but also from the side of the lender selling you the debt. In addition, consumer financing really doesn’t work for improving the lives of people historically.

Avoiding Cryptocurrency

I do not invest in cryptocurrency and will never do so under the current circumstances. Please don’t send me requests to analyze Cryptos, I will not do so. Learn why I don’t invest in Crypto.